440 Dixwell Avenue, New Haven.

Summary

Opportunity to invest in a rare, 4 family which offers approx. 6,300 sq. ft. FULLY RENTED OUT. Sold as is, inspection for informational purposes. Close to Yale University, Yale Hospital, and downtown New Haven. This investment, managed by Property Management CT, offers diverse tenant options that effectively mitigate risk and ensure stable occupancy rates.

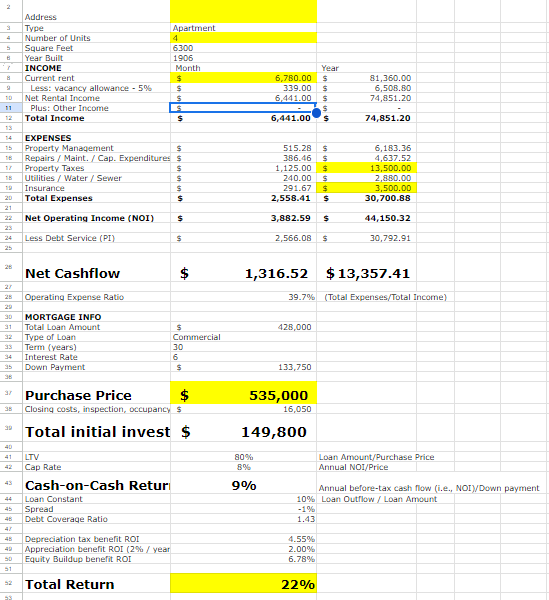

The fully leased property has a gross rental income exceeding $74,000 per yea. The four-plex includes two spacious 4-bedroom, 1-bath apartments and two large 3-bedroom 1-bath units.

Proof of funds or prequalification required to submit offer.

Highlights

-Large backyard

-Off Street Parking

-9% Cap Rate

-100% Occupied

-High demand location

This rare four-family investment opportunity delivers both scale and stability in one of New Haven’s highest-demand rental corridors. The property offers approximately 6,300 square feet of total living space and remains fully rented, which shows strong tenant demand and consistent cash flow. Investors often underestimate how difficult it is to find a multi-unit asset of this size near Yale University, Yale Hospital, and downtown New Haven. Yet this building sits within minutes of all three, which increases the long-term value of the location and broadens the pool of prospective renters. Inspection is for informational purposes only, and the property transfers strictly as-is, which removes ambiguity about seller expectations.

However, before assuming “as-is” means future risk, consider that the property already operates at full occupancy with a proven rental history. Tenants stay in this area because they value proximity to work, school, transportation, and city amenities. This gives investors a natural buffer against vacancy swings, but it does not remove the need to evaluate whether rents are at market rate or whether operational improvements could unlock higher net income. You gain stability, yet you still have levers to increase performance.

The rental income exceeds $74,000 per year, which creates a strong foundation for predictable returns. Investors often focus on the gross number but overlook the importance of tenant mix. This building includes two large four-bedroom, one-bath units and two spacious three-bedroom, one-bath units, which creates pricing diversity that many small multifamily properties lack. Units of this size attract families, graduate students, and long-term tenants who often renew, and renewal patterns matter more to cash flow than most buyers admit. A stable tenant base reduces turnover costs, protects NOI, and lowers management overhead. Still, a serious buyer should verify lease terms, confirm payment history, and check whether future rent adjustments are possible within current agreements.

Property Management CT currently manages the asset and maintains occupancy across multiple unit types. Their involvement reduces the learning curve for an incoming owner who may not be familiar with tenant needs in this micro-market. Yet you should question whether keeping the same management team best serves your investment strategy. Some operators increase NOI by tightening expenses, others by enhancing resident services, and others by adjusting rent structures. A property with this footprint gives you room to choose the approach that fits your return goals.

The location remains one of its strongest selling points. New Haven continues to grow through education, biotech development, and hospital expansion. These drivers create durable demand that supports both current rents and long-term appreciation. Investors often chase cap rate alone, but location quality protects your downside in a way a spreadsheet cannot. A strong location keeps units filled in every market cycle.

The property also offers a large backyard and off-street parking, which add real value for tenants who want outdoor space or private parking in a busy city environment. These features strengthen retention and make the units more competitive against smaller apartments that lack both amenities. A serious investor should consider how small upgrades to these shared areas might unlock higher rent potential or differentiate the property even further.

Proof of funds or a prequalification letter is required with any offer. This ensures only prepared buyers enter the negotiation process and protects seller timelines.