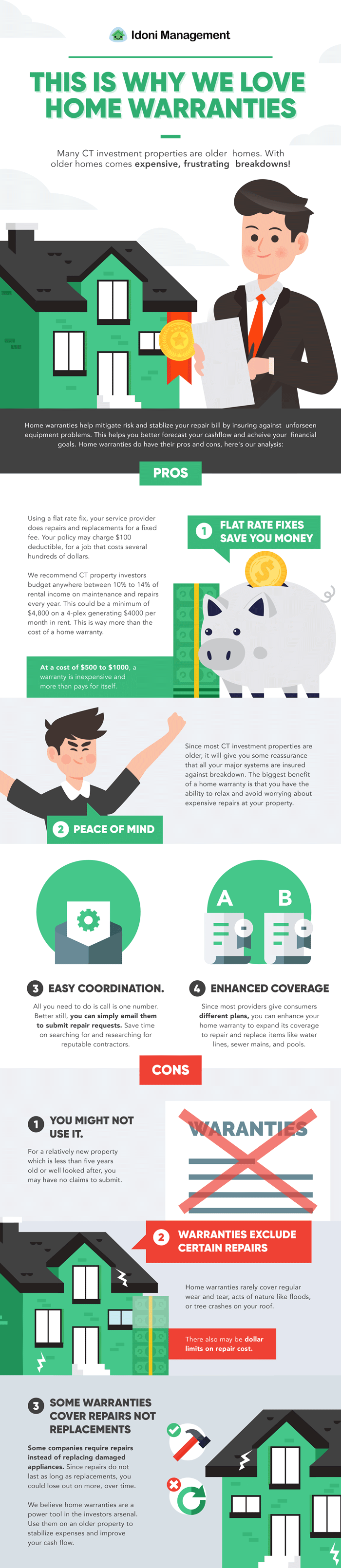

Many CT investment properties are older homes.

Consequently, with older homes comes expensive, frustrating breakdowns!

One large repair bill such as a furnace replacement or water main break can wipe out your profit for years!

Home warranties help mitigate risk and stabilize your repair bill by insuring against unforseen equipment problems. This helps you better forecast your cashflow and acheive your financial goals.

Home warranties do have their pros and cons, here’s our analysis:

Advantages of Home Warranties

1. Flat Rate Fixes Save You Money

Using a flat rate fix, your service provider does repairs and replacements for a fixed fee. Your policy may charge a $100 deductible for a job that costs several hundreds of dollars. With a base premium of $500 to $1000 per year, a warranty is inexpensive and more than pays for itself.

We recommend CT property investors budget anywhere between 10% to 14% of rental income on maintenance and repairs every year. This could be a minimum of $4,800 on a 4-plex generating $4000 per month in rent. This is way more than the cost of a home warranty.

2. Peace Of Mind

Since most CT investment properties are older, it will give you some reassurance that all your major systems are insured against breakdown. The biggest benefit of a home warranty is that you can relax and avoid worrying about expensive repairs at your property.

3. Easy Coordination

All you need to do is call is one number. Better still, you can simply email them to submit repair requests. Save time on searching for and researching reputable contractors.

4. Enhanced Coverage

Since most providers give consumers different plans, you can enhance your home warranty to expand its coverage to repair and replace items like water lines, sewer mains, and pools.

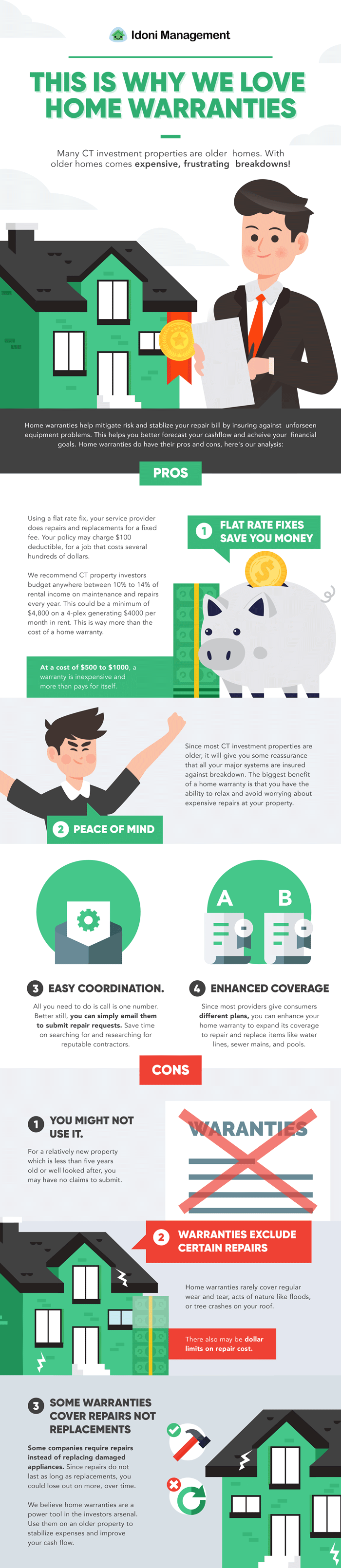

Disadvantages of Home Warranties

1. You Might Not Use It

For a relatively new property which is less than five years old or well looked after, you may have no claims to submit.

2. Warranties Exclude Certain Repairs

Home warranties rarely cover regular wear and tear, acts of nature like floods, or tree crashes on your roof. There also may be dollar limits on repair cost.

3. Some Warranties Cover Repairs Not Replacements

Some companies require repairs instead of replacing damaged appliances. Since repairs do not last as long as replacements, you could lose out on more, over time.

Are home warranties worth it?

We believe home warranties are a powerful tool in the investors arsenal. Use them on an older property to stabilize expenses and improve your cash flow.