Connecticut Lease Documentation Basics

In Connecticut, lease agreements are legally required to clearly outline terms such as rent, payment schedules, and responsibilities for both landlords and tenants. These agreements must comply with state laws, including limits on security deposits, mandatory disclosures, and tenant protections. Key points include:

- Security Deposits: Capped at two months’ rent for tenants under 62, or one month for those 62 and older. Deposits must accrue interest and be returned within 21 days of move-out.

- Payment Rules: A 9-day grace period applies for monthly leases before late fees, which are capped at $5/day or 5% of rent, up to $50.

- Prohibited Clauses: Leases cannot enforce electronic-only payments or waive tenant rights like eviction processes.

- Mandatory Disclosures: Include lead-paint hazards for pre-1978 properties and details of security deposit accounts.

- Recent Updates: New laws now limit late fees, ban application fees (except for capped screening costs), and require 45 days’ notice for rent increases.

Following these rules helps avoid disputes and ensures compliance with Connecticut’s landlord-tenant laws.

Required Elements of a Connecticut Lease Agreement

Property and Party Information

A Connecticut lease agreement must clearly identify the key details about the property and the parties involved. This includes the landlord’s name, the name of any authorized property manager, and the address for rent payments and repair requests. All tenants and occupants should be listed by name, and every adult tenant is required to sign the lease to confirm their responsibilities. Additionally, the lease must describe the property being rented. While not legally required, adding a signed move-in condition statement can help avoid disputes later, especially regarding security deposit deductions. Lastly, the lease should specify its duration and any conditions for renewal.

Lease Duration and Terms

The lease must outline its term – whether it’s weekly, monthly, yearly, or for another specified period. If no fixed term is provided, Connecticut law considers the arrangement a month-to-month tenancy (or week-to-week if rent is paid weekly). For agreements with automatic renewal clauses, the lease should clearly state the required notice period – usually 30 or 60 days – to prevent unintended renewals. It’s also important to include any early termination conditions, such as rights for domestic violence victims or active-duty servicemembers to end the lease early. Including clear rent details and payment processes further strengthens the agreement.

Rent Amount and Payment Details

Rent details are a crucial part of any lease agreement. The lease must specify the rent amount, the due date (typically monthly), and the address where payments should be sent. Connecticut law ensures tenants have payment flexibility by prohibiting landlords from requiring electronic transfers as the sole payment method. Alternatives like checks or money orders must also be accepted. The law also mandates a grace period: 9 days for monthly leases and 5 days for weekly tenancies. Late fees can only be charged after these grace periods. If you plan to charge fees for returned checks, the lease should clearly state the amount. Although Connecticut law doesn’t specify a required notice period for rent increases, it’s common practice to include a 30- or 60-day notice clause in the lease for transparency.

| Lease Type | Grace Period | Notice to Quit (Non-Payment) |

|---|---|---|

| Monthly or Fixed-Term | 9 days | 3-day notice served on the 10th day |

| Weekly or Oral | 5 days | Served after the 5th day |

Required Disclosures in Connecticut Leases

Lead-Based Paint Disclosure

Federal law mandates that landlords disclose any known lead-based paint hazards in properties built before 1978. This rule applies to all rental properties in Connecticut that fall under this category. The disclosure must be provided to tenants before they sign the lease, ensuring they are aware of any potential health risks. Even if no lead-based paint is present, both the landlord and tenant are required to complete and sign the disclosure form.

Security Deposit Information

Connecticut leases must clearly state the amount of the security deposit, which cannot exceed two months’ rent – or one month’s rent for tenants aged 62 or older. The lease must also disclose that deposits are held in a Connecticut bank and accrue 0.49% interest annually, as long as rent is paid on time. This interest can either be paid directly to the tenant each year or applied as a credit toward their rent. However, tenants forfeit interest for any month they are more than 10 days late on rent unless a late fee is outlined in the lease.

The lease should also detail the timeline for returning the security deposit: landlords must return it within 21 days after the tenant moves out, or within 15 days of receiving a forwarding address, whichever is later. Any deductions for damages or unpaid rent must be itemized in a written notice provided to the tenant.

"A security deposit remains the tenant’s property, but the landlord holds a security interest in it." – State of Connecticut Department of Banking

Including clear terms about deposits, alongside detailed utility and maintenance responsibilities, helps define financial obligations for both parties.

Utility and Maintenance Responsibilities

Leases in Connecticut must clearly assign responsibility for utilities such as electricity, gas, water, sewer, and trash, along with their respective due dates. This transparency helps avoid disputes over utility costs. Maintenance responsibilities must also be outlined, specifying which repairs or services the landlord will handle and which are the tenant’s responsibility.

Under Connecticut law, landlords are required to provide essential services, including heat, hot water, functioning plumbing, and smoke alarms. State law (Sec. 19a-109) prohibits landlords from terminating these essential services. If tenants leave unpaid utility bills, landlords may deduct these amounts from the security deposit, but only if the charges are itemized in the written notice of damages provided after move-out.

Connecticut’s Landlord-Tenant Laws & Rights: Everything You Need To Know

Connecticut Security Deposit Rules

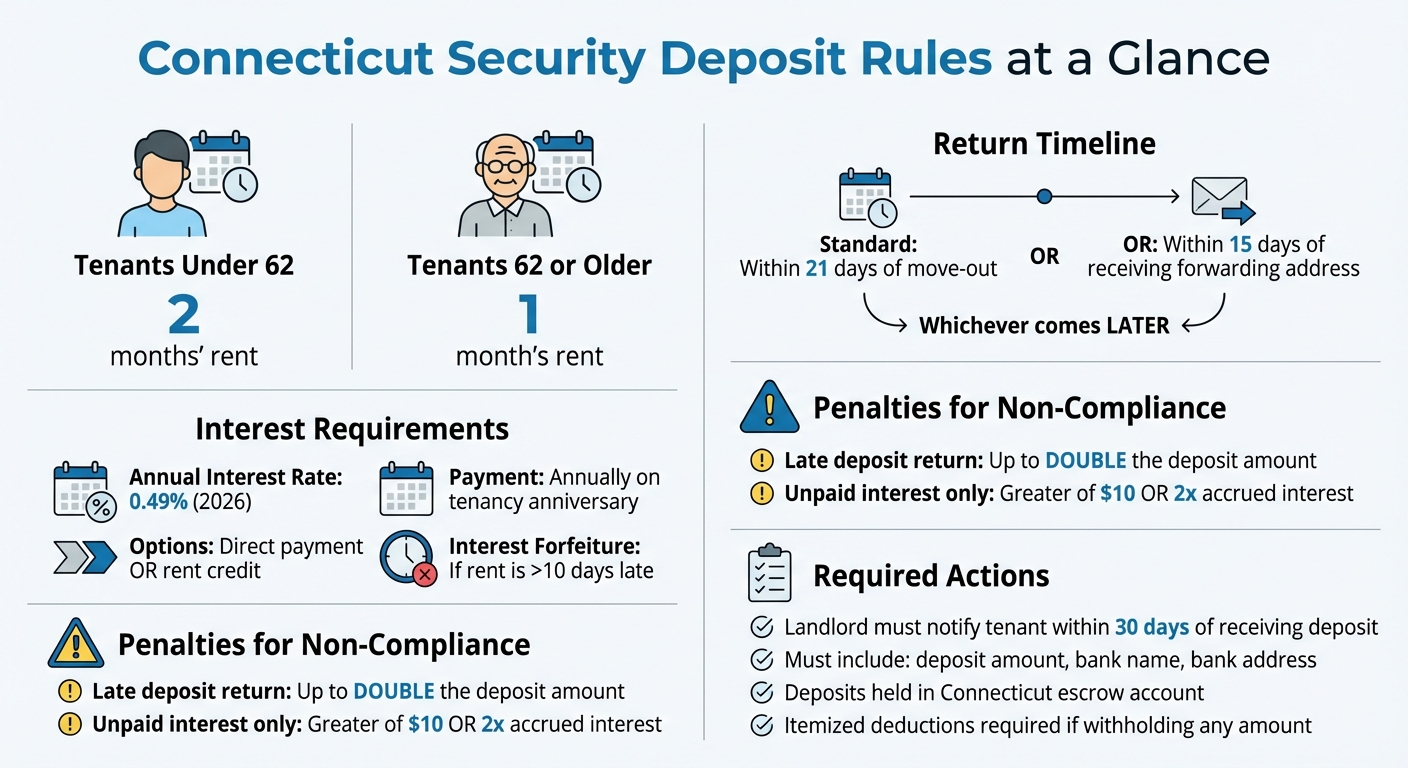

Connecticut Security Deposit Rules and Limits by Tenant Age

Security Deposit Limits

In Connecticut, landlords must follow specific rules regarding security deposits. For tenants under the age of 62, the maximum deposit allowed is two months’ rent. For tenants aged 62 or older, it’s capped at one month’s rent. These limits apply strictly to the monthly rent amount and do not include additional charges like the first month’s rent or deposits for items such as keys or special equipment. If a tenant turns 62 during their lease, they can request a refund of any amount exceeding the one-month limit.

| Tenant Category | Maximum Security Deposit Limit |

|---|---|

| Under 62 years of age | Two months’ rent |

| 62 years of age or older | One month’s rent |

Security deposits must be placed in an escrow account at a financial institution within Connecticut. Landlords are required to notify tenants in writing within 30 days of receiving the deposit. This notice must include the deposit amount, along with the name and address of the bank where it is being held. These rules also tie into how deposits are refunded, as explained below.

Deposit Return Requirements

Connecticut law outlines clear steps for returning security deposits. Deposits must be refunded within either 21 days or 15 days, depending on the circumstances. If any amount is withheld for damages or unpaid rent, landlords must provide an itemized statement detailing these deductions within the same timeframe.

Failing to return the deposit on time can lead to serious penalties. Landlords may be required to pay double the deposit amount. If only the interest is unpaid, the penalty is the greater of $10 or twice the accrued interest.

Interest on security deposits accrues at an annual rate of 0.49% for 2026. This interest must be paid to tenants on the anniversary of their tenancy, either as a direct payment or as a credit toward their rent. However, tenants lose any accrued interest for months when rent is more than 10 days late, even if a late fee is applied. To avoid misunderstandings, tenants should provide their forwarding address in writing – ideally using certified mail with a return receipt requested. This ensures a smoother process for receiving their deposit back.

sbb-itb-66a7c69

Lease Execution and Record-Keeping Requirements

Signatures and Lease Delivery

In Connecticut, a rental agreement is defined as "all agreements, written or oral". While oral leases are legally valid, they often default to month-to-month arrangements, which can be harder to enforce. This makes written agreements the smarter choice for both landlords and tenants.

Before a tenant moves in, landlords must provide the contact details of the property manager and the person authorized to receive legal notices. This ensures clear communication channels from the start.

For any cash payments, landlords are required to issue a receipt that includes the date, amount, and purpose of the payment, as outlined in Connecticut General Statutes Sec. 47a-3a.

Additionally, landlords must include specific disclosures in the lease. If the property has a fire sprinkler system, a notice about its status and last maintenance date must be printed in at least 12-point bold type. For units within a common interest community, written notice must be provided before the lease is signed.

These steps not only comply with legal requirements but also set the stage for effective and organized record-keeping.

Document Retention Guidelines

Even though Connecticut doesn’t specify a mandatory retention period for rental records, keeping detailed and organized documentation is crucial. For example, disputes over security deposits – limited to $5,000 or less in small claims court – can be resolved more effectively with proper records.

Landlords should retain copies of signed leases, move-in and move-out checklists, and all written communications with tenants. Photos or videos taken before move-in and after move-out can serve as valuable evidence in damage disputes and justify security deposit deductions.

It’s also essential to maintain records of cash receipts, security deposit details, and interest calculations. Connecticut law requires landlords to return a tenant’s security deposit – or provide an itemized list of deductions – within 30 days of move-out. Keeping a written record of the tenant’s forwarding address ensures this timeline is met.

To further protect against disputes, landlords should document maintenance requests, repair records, and any correspondence with tenants. Connecticut regulations even allow tenants to review documents related to termination notices, highlighting the importance of having everything in writing.

Strong lease execution and organized record-keeping not only ensure compliance with Connecticut laws but also protect the interests of both landlords and tenants. They create a foundation for clear, enforceable agreements and smoother interactions throughout the tenancy.

2025 Updates to Connecticut Lease Laws

Recent Law Changes

Landlords in Connecticut must revise their lease agreements to comply with several key regulatory changes introduced in 2024 and 2025. These updates affect fee limits, application processes, rent increase notifications, pre-occupancy inspections, and eviction record handling. Here’s a breakdown of the most important changes:

Late fees now have strict limits. Landlords can charge no more than $5 per day, with a maximum total of $50 or 5% of the monthly rent – whichever is lower. Additionally, landlords must allow a 9-day grace period for monthly leases (up from 5 days previously) before imposing late fees. For weekly leases, the grace period is now 4 days. Lease agreements must clearly outline these changes, and landlords may need to adjust their payment systems to avoid charging fees prematurely.

Application fees are no longer allowed. Landlords can only charge for the actual tenant screening report, and even that is capped at $50. This means application processes must be updated to ensure no additional fees are charged during the application stage.

Rent increase notices now require more time. For leases signed or renewed on or after October 1, 2024, landlords must provide tenants with at least 45 days’ written notice before implementing a rent increase. Lease templates should be updated to reflect this extended notice period.

One of the most impactful changes involves pre-occupancy inspections. Tenants now have the right to a joint walk-through inspection using a standardized checklist. Landlords cannot deduct from security deposits for damages noted on this checklist, so it’s crucial for both parties to conduct a thorough inspection together.

Finally, eviction record sealing rules have been strengthened. Cases that are dismissed, withdrawn, or decided in favor of the tenant must be removed from public records within 30 days. Additionally, legislation passed in late 2025 (H.B. 8002) expanded the authority of fair rent commissions to address cases of "harsh and unconscionable" rent increases.

These updates require landlords to review and revise their current practices and documentation to ensure compliance with the new laws.

Conclusion

Key Points Summary

Connecticut’s lease documentation standards are among the most thorough, and here’s a quick rundown of what they entail. Leases must be in writing and clearly outline property details, rent amounts, payment terms, and tenant responsibilities. This helps avoid misunderstandings and keeps everything transparent for both parties. Additionally, leases must include safety disclosures and are prohibited from containing clauses that waive tenant rights or force electronic payments as the sole option.

For security deposits, the rules are straightforward: tenants under 62 can be charged up to two months’ rent, while those 62 or older are capped at one month. These deposits must be kept in an interest-earning escrow account, with the tenant receiving the interest annually. If you fail to return the deposit on time after a tenant moves out, you could face penalties of up to twice the deposit amount.

Following these regulations is essential to avoid legal issues and ensure smooth property management.

How Idoni Management Can Help

Navigating these requirements can be tricky, but that’s where professional management comes in. Idoni Management offers full-service residential property management across Connecticut, ensuring your leases comply with state laws. Their services include everything from drafting legally sound leases to tenant screening, automated rent collection, and efficient maintenance coordination – all designed to keep your property running smoothly and within legal bounds.

Whether you’re looking for a one-time lease review or comprehensive management services starting at 10% of your monthly rent, Idoni Management has the expertise to protect your investment. Their team stays up-to-date with Connecticut’s regulations, giving you peace of mind while they handle the administrative details. To learn more, schedule a 20-minute consultation and find out how they can simplify your property management needs.

FAQs

What happens if a landlord in Connecticut doesn’t return a tenant’s security deposit on time?

If a landlord in Connecticut doesn’t return a tenant’s security deposit within the required time frame, they could face hefty financial consequences. Under state law, landlords might be required to pay double the original deposit amount, plus any actual damages the tenant has experienced. On top of that, they could also be on the hook for attorney’s fees and punitive damages in certain situations.

To steer clear of these penalties, landlords need to follow Connecticut’s security deposit rules. This includes returning the deposit within 30 days of the tenant moving out or, if deductions are necessary, providing an itemized list of those deductions within the same timeframe.

What are the rules for late fees and rent increase notices under Connecticut law?

Under Connecticut law, landlords can only charge late fees if the rent is at least 10 days overdue, and those fees must be reasonable. Typically, any late fee exceeding 5% of the monthly rent is viewed as excessive. When it comes to rent increases, landlords are required to provide adequate notice. However, recent updates haven’t clarified specific changes to the notice periods. It’s crucial to stay updated on state regulations to ensure all lease terms comply with the law.

What disclosures are required in a Connecticut lease agreement?

In Connecticut, a lease agreement needs to cover a few key elements. These include a clear description of the rental property, the length of the lease, the names of both the landlord and tenant, the agreed monthly rent, the due date for payments, and any late fees that might apply. It should also spell out the landlord’s rules, the tenant’s rights and responsibilities, and clarify who is responsible for property maintenance.

Including detailed disclosures is crucial. They help ensure the lease aligns with state laws and provide protection for both landlords and tenants throughout the rental period.